Ян Половчик про катастрофічне падіння вартості російських публічних компаній

Доктор економічних наук, професор Познанського університету економіки і бізнесу та Донецького національного університету імені Василя Стуса Ян Половчик про катастрофічне падіння вартості російських публічних компаній.

«Wednesday, 02nd March, was the seventh day of the Russian invasion of Ukraine.

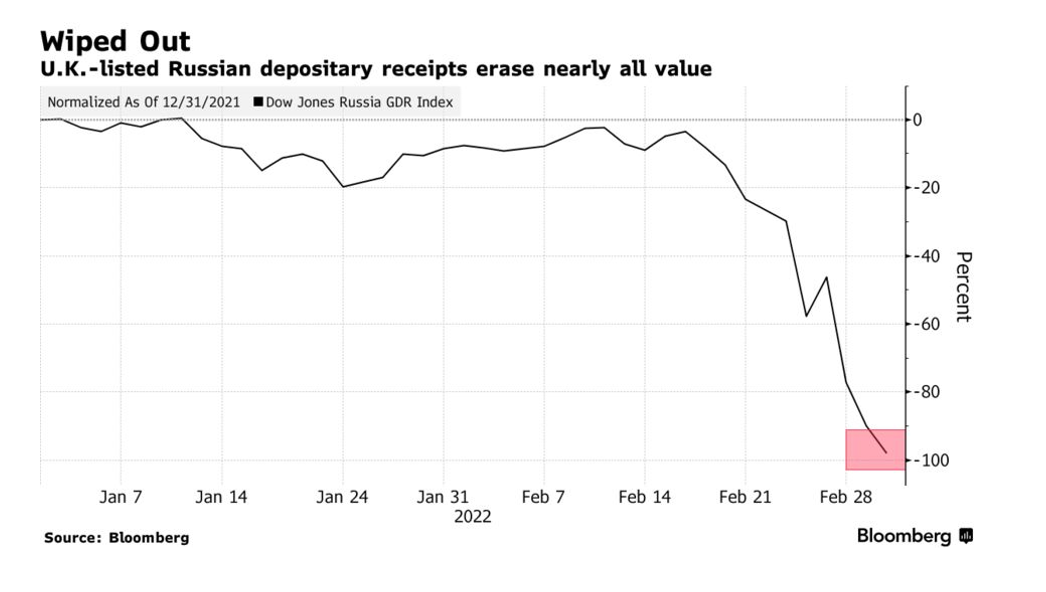

Russia’s attack on Ukraine and the imposition of sanctions by Western countries led to a gigantic sell-off of Russian companies on the London Stock Exchange. As a result, their capitalization has dropped dramatically. U.K.-listed depositary receipts of Russian companies are evaporating in value as sanctions take effect. The Dow Jones Russia GDR Index, which tracks London-traded Russian companies, has plunged 98% in two weeks. The slump has wiped out $572 billion from the market value of 23 stocks, including Gazprom, Lukoil, Sberbank and Rosneft, according to Bloomberg calculations.

Gazprom capitalization, according to quotations from London, on Wednesday was less than $ 603.7 million, what means that Gazprom’s capitalization on the London Stock Exchange fell by 99,45 percent during last two weeks. The value of Lukoil fell to USD 221.71 million, by 99.64%.

Novatek’s capitalization, compared to the previous year’s situation, fell by 99.74 percent, to 182.2 million dollars, and the fertilizer concern Phosagro lost 99.77 percent. The value and capitalization was $ 19 million on Wednesday, according to Blomberg.

The value of Rosneft on the London Stock Exchange on Wednesday was less than $ 10.5 billion (down 87.7% over the last year), and Norilsk Nickel on Wednesday was valued at $ 1.62 billion in London (a decrease by almost 96.6%).

Europe is carving up Sberbank’s business in the region after sanctions sparked by President Putin’s invasion of Ukraine prompted a run on its local deposits. Meanwhile, European energy companies are distancing themselves from Gazprom, with Shell Plc and Italy’s Eni SpA ending joint ventures.

Shares of Russian companies are also listed in Moscow, but the local stock exchange suspended trading on Tuesday and was still closed on Wednesday. With the Russian central bank taking the unusual step of closing stock trading on the Moscow exchange, the movement in shares of Russian firms listed elsewhere is an indication of how local equities may react to the sanctions.

This is the price of Putin’s war for the Russian economy! Russians, think how to live with such a ruler!»

Dr hab. Jan Polowczyk, prof. PUEB, prof. Vasyl’ Stus Donetsk National University